-

- City Plans

- Impact Areas

- Business Toolbox

- Community Development

- Economic Inclusion

- Housing Improvement Programs

- Historic Preservation

- Fair Housing

- Development & Building Regulation

- Development Review Schedules

- Boards and Committees

- Request for Proposal

- Staff Directory

- Development Projects

- Housing Affordability Analysis

- New Housing Fee Report

TID20

-

TID 20

CITY OF RACINE TO EXPLORE THE CREATION OF A NEW TAX INCREMENT DISTRICT

The City of Racine, like many communities, is witnessing changes to the health and quality of its retail properties. The City recognizes opportunity to reposition the area surrounding the Regency Mall for reinvestment and growth, and plans to create Tax Increment District (TID) No. 20 to assist in improving the corridor. The target area for TID No. 20 includes 24 parcels and totals approximately 133.9 acres. The area includes Regency Mall, the mall outlots, Target, and High Ridge Center, including Home Depot and Toys R Us.

The City of Racine’s largest commercial hub is centered at Green Bay Road and Durand Avenue. The area is anchored by the Regency Mall, which opened in 1981 as a major shopping destination for Racine County. Other shopping and restaurant destinations in the Racine Retail Corridor include Target, Home Depot, Toys R Us, Kmart, Dick’s Sporting Goods (Mt. Pleasant), Michaels (Mt. Pleasant), Barnes and Noble (Mt. Pleasant), Hobby Lobby, Applebees, Starbucks, Olive Garden, and others.

While the corridor benefits from a strong cluster of nationally-branded retailers, the area faces challenges. The retail market place has become more competitive with more consumers buying online and alternative destinations within Southeast Wisconsin attracting Racine shoppers. As a result of conditions, a number of stores have left or have announced closings (JC Penney, Kmart, and Sears) in the Racine Corridor and sales volumes from some of the remaining stores are eroding.

“Limited property reinvestment, increasing vacancy, and eroding tax base is a significant cause for concern for the City,” notes Mayor John Dickert. “Without an intervention, the retail cluster could continue to erode and leave the area with more vacant properties. However, the community can help to turn the tide. With the recent purchase of Regency Mall by Hull Property Group, the City and the area property owners have an opportunity to come together and reposition the area as a vibrant retail destination.”

The over 248,000 people and 95,000 households living within a 20 minute drive time of Green Bay Rd and Durand Avenue are a valuable and attractive demographic that existing and future retail operations are interested in serving.

To facilitate investment in the area, the City of Racine is proposing formation of TID No. 20. The primary purpose of the TID is to provide the necessary incentives and public infrastructure improvements needed to encourage economic development and increase property values. The Project Plan for the Creation of Tax Incremental District No. 20 (Regency Mall) 22-year expenditure period estimates total project expenditures of $15.7 million in several phases.

- Adoption of the TID plan and formation of the TID will set the base value for all properties in the TID.

- Any additional tax increment value across all taxing jurisdictions (Racine County, Racine Unified School District, Gateway Technical College and City of Racine) would be available to make identified expenditures in the TID plan including incentives and public improvements.

- Any incentive provided would require a developer agreement between the developer and the City that includes agreed upon milestones and metrics to receive incentive assistance.

- All developer agreements are approved by the City of Racine Common Council.

The City of Racine will hold a public hearing on the proposed TID No. 20 on Wednesday, March 29 in conjunction with the City’s Plan Commission. Final consideration by the Racine Common Council is planned for April 18.

In addition to the formation of TID No.20, the creation of a business improvement district (BID) is being investigated with property owners and stakeholders. The BID will levy an additional tax on the businesses in the area to fund improvement projects within the district’s boundaries.

-

TID20 FAQ

What is a TID?

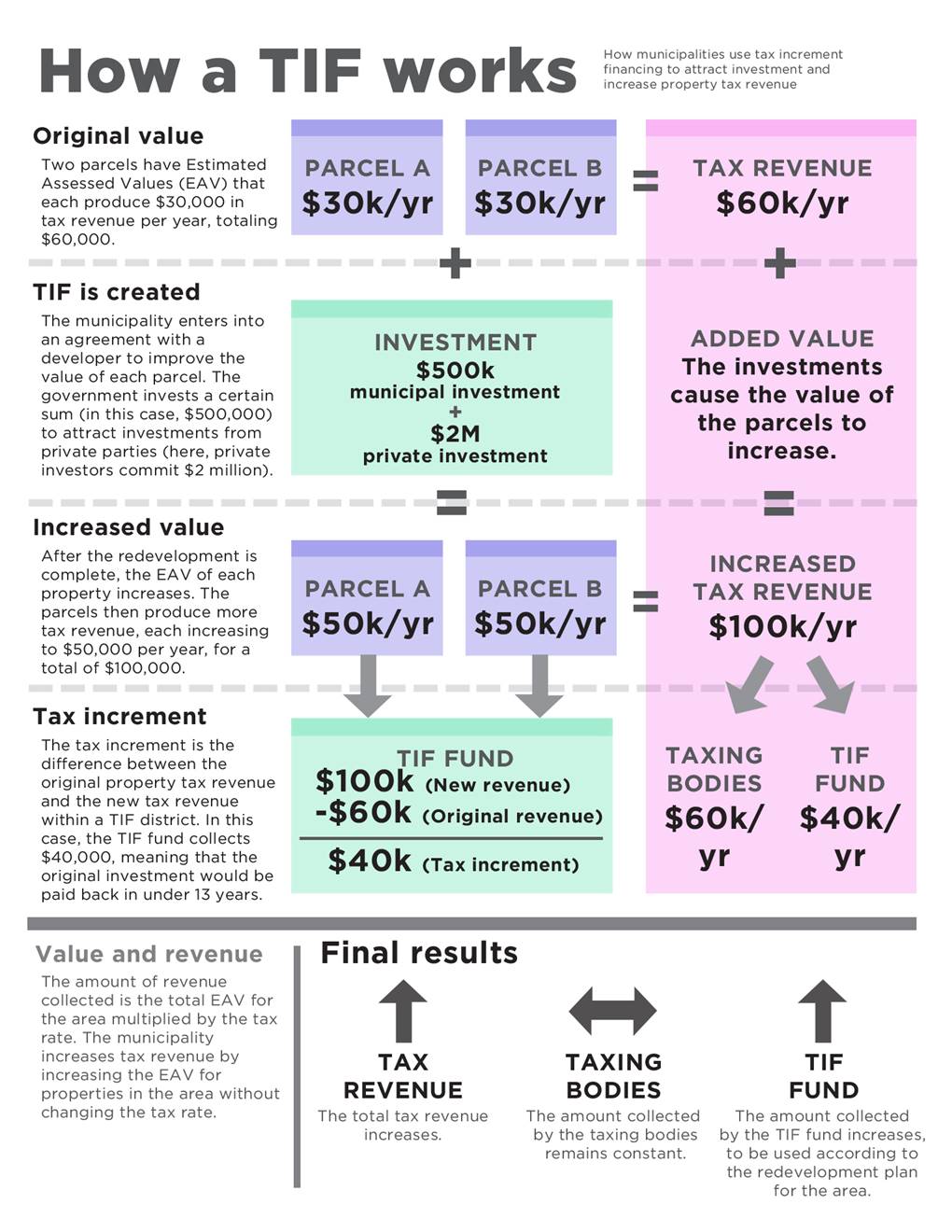

A TID is a “tax increment district.” TIDs use future property tax revenue increases from a specific areas/district toward incentives and public infrastructure improvements necessary to encourage economic development and increase property values. The improvements and incentives paid through the TID trigger increases in tax revenue above what occurs, or would have occurred within the district without the investment.

The Project Plan for the Creation of Tax Incremental District No. 20 (Regency Mall area) estimates total project expenditures of $15.7 million of future property tax revenue increases in several phases through the TID’s 22-year expenditure period. (Graphic B – TID Detailed)

Adoption of the TID plan and formation of the TID will set the base value for all properties within the boundaries of the TID. Any additional tax increment value across all taxing jurisdictions (Racine County, Racine Unified School District, Gateway Technical College and City of Racine) would be available to make identified expenditures within the district including incentives and public improvements

>Any incentive provided would require a development agreement between the developer and the City that includes agreed upon milestones and metrics to receive incentive assistance. All development agreements are approved by the City of Racine Common Council.

How long does a TID last?

TID 20 is proposed to be a 27 year TID, and has a 22 year expenditure period.How does a TID help businesses in the area?

Businesses and property owners within the TID are eligible to receive economic assistance in the form of infrastructure improvements that benefit the district and business incentives to support improved economic activity. The TID is a tool that allows local units of government to reinvest improvements in the tax base back into the district to create even more economic development.Does Racine have any other TIDs?

Yes. The TID presently proposed would be the twentieth TID created within the City of Racine. However, there are now thirteen tax increment districts that are operational within the City. The most recent, TID 19, is for the Uptown area. In just its first year it has helped incentivize two new-redevelopments – Culinary Infusions and the Ajax Veteran’s Apartment Complex.What is the taxpayer impact?

There are no impacts to the taxpayer as the taxes generated within the base year of the TID return to the local governmental units in the same amount over the next 27 years. Only increases in tax revenue (also called “increment”) are used to incentivize development or pay for infrastructure investments within the TID.What area does TID 20 cover?

The target area for TID No. 20 includes 24 parcels and totals approximately 133.9 acres. The area includes Regency Mall, the mall out lots, Target, and High Ridge Center, which includes the Home Depot and Toys R Us.

Who Runs the TID?

The TID is managed by the City of Racine jointly through its

Finance Departmentand

Department of City Development. The City Redevelopment Authority often reviews and recommends TID projects and incentives to the Common Council. Annual reports on the TID are made to the State of Wisconsin. Decisions regarding the use of increment within the TID are subject to approval by Common Council or through development agreement between the developers and the City (through its Common Council).

Who bought the Mall and what’s their history?

Hull Property Group is developing plans to redevelop and invest in Regency Mall. The goal is to stabilize and transform the property to stop valuable tenants from leaving and attract new nationally branded tenants. The Hull Property Group’s portfolio includes 28 small market malls containing 12.3M SF. The company has a long track record of acquisition and redevelopment of distressed enclosed mall properties in secondary and tertiary markets that have been mismanaged and fallen out of favor. In over 25 years the Hull Group has never sold a mall and has a reputation as the “go to” developer for stabilization, transformation, and repositioning of distressed enclosed regional malls.

An example of Hull Property Group’s success in mall redevelopment can be seen in the Danville Mall in Danville, VA. The Hull Property Group purchased the Danville Mall in 2012 as a distressed property. Since then they have carried out their programmatic approach to perform large-scale interior and exterior renovations which resulted in a first class shopping experience. The improvements include installing new carpeting and lighting throughout the property, permanently covering vacancies, and landscaping the exterior to open up sightlines and enhance visibility. The Hull Group invested $6.2 M to stabilize, transform and reposition the property. These renovation efforts attracted national retailers including Dunham’s Sports, Rue21, Justice, and Rack Room Shoes.

The improvements to the Danville Mall have encouraged adjacent property owners to invest within the retail corridor, benefiting the Danville community through increased property and sales taxes. The Hull Property Group continues to invest in improvements to the property including the development of a three tenant building anchored by Chipotle Restaurant on a small outparcel.

How and when will we know the TID is successful?

When the TID generates an increase in increment and is able to share the increment to create economic development, it is successful. Another way to show success is to achieve objectives and projects proposed within the TID Project Plan. Some successful TIDs are able to pay off project expenses and incentives early and, thus, can be “closed” early and all taxpayers within a municipality may enjoy the improvements to the tax base.What is the difference between a TID and a BID?

A TID is essentially a plan to increase the value of the business district. A BID (business improvement district) is a representative group of business people who work together to share ideas, and marketing and event expenses with the goal to increase business for the good of the entire area. BIDs are paid for through an additional tax on property owners within the district. A BID is not a requirement of a TID, but the City encourages the creation of a BID to help accelerate business development.